Introduction Forex trading, or foreign exchange trading, is a global marketplace for exchanging national currencies against one another. Given the global reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. For aspiring traders, mastering forex involves understanding the intricate workings of market mechanics,

Forex Trading Guide: Understanding Forex Leverage And Margin

Introduction Forex trading, a dynamic and fast-paced market, offers numerous opportunities for traders to capitalize on currency fluctuations. Central to successful forex trading are the concepts of leverage and margin. These tools enable traders to control larger positions with a relatively small amount of capital. This comprehensive guide will delve into the intricacies of leverage

Japan’s Massive Forex Intervention: A Strategic Move To Stabilize The Yen

Introduction In a significant financial move, Japan has reportedly spent approximately ¥5 trillion on foreign exchange interventions to stabilize the yen. This strategic expenditure highlights Japan’s proactive measures to manage its currency value amidst global economic fluctuations, aiming to mitigate excessive volatility and protect its economic stability. This intervention marks a critical point in Japan’s

How To Start Forex Trading In 3 Steps

Introduction Beginning a journey in foreign exchange trading can be an experience that is both exhilarating and intimidating. Whether you are a newbie trader or an experienced trader who is wanting to revisit the fundamentals, it is essential that you have a solid understanding of the core processes. This article provides an overview of three

Stock Research: How To Conduct Your Due Diligence In 4 Steps

Introduction An investment in the stock market can be a lucrative option; nevertheless, in order to achieve success, one must engage in comprehensive research and keep a fundamental understanding of the market. The execution of exhaustive due diligence is a fundamental requirement if one want to reduce risks and maximize earnings. A concise tutorial that

Choosing The Best Forex Trading Platform In 2024: An Essential Guide For Traders

Introduction As the world of online trading continues to evolve, forex traders are constantly on the lookout for the most efficient and reliable trading platforms. In 2024, several platforms have distinguished themselves by offering superior tools, user-friendly interfaces, and comprehensive support. This guide aims to help both novice and experienced traders understand what makes a

Understanding Volatility In Forex Trading

Introduction Volatility is a fundamental aspect of the forex market, indicating the rapidity and extent of currency price changes. It mirrors the dynamic nature of global economic activities, influencing trading decisions and strategies. For traders, understanding volatility is not just about recognizing how currency pairs fluctuate but also about leveraging these movements for potential gains.

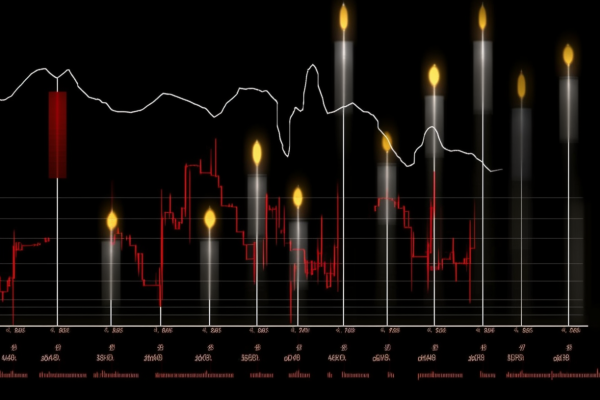

How to Read Forex Charts

Forex charts are used to track the price movements of currency pairs. They show the historical prices of a currency pair over a period of time, and can be used to identify trends, patterns, and potential trading opportunities. There are two main types of Forex charts: line charts and candlestick charts. Line charts simply connect

How to Develop a Forex Trading Plan

A Forex trading plan is a written set of rules and guidelines that you will follow when trading Forex. It should include your entry and exit criteria, risk management strategy, and money management strategy. Having a trading plan is essential for success in Forex trading. It will help you to stay disciplined and to avoid

How to Stay Disciplined in Forex Trading

Discipline is essential for success in Forex trading. The market can be unpredictable and volatile, and it is important to stick to your trading plan even when things are not going your way. Here are some tips on how to stay disciplined in Forex trading: Have a trading plan. A trading plan is a set