Introduction

Forex trading, or foreign exchange trading, is a global marketplace for exchanging national currencies against one another. Given the global reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. For aspiring traders, mastering forex involves understanding the intricate workings of market mechanics, honing skills in technical analysis, and practicing robust risk management strategies. This tutorial aims to equip you with the knowledge and tools needed to excel in forex trading.

Understanding Market Mechanics

The forex market operates 24 hours a day, five days a week, across major financial centers worldwide, including London, New York, Tokyo, and Sydney. This constant activity creates opportunities for traders at any time of the day. Here’s what you need to know about market mechanics:

Currency Pairs: Forex trading is always conducted in pairs. The first currency in the pair is known as the base currency, and the second is the quote currency. Popular pairs include EUR/USD, GBP/USD, and USD/JPY.

Pips and Lots: A pip is the smallest price move that a given exchange rate can make based on market convention. Understanding pips and lot sizes (standard, mini, and micro) is essential for managing your trades and calculating potential profits and losses.

Leverage and Margin: Leverage allows traders to control a larger position with a smaller amount of actual trading funds. While leverage can magnify profits, it can also magnify losses. Margin is the amount of money needed to open a leveraged position, which serves as a good faith deposit.

Technical Analysis

Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements. Aspiring traders must become proficient in various technical analysis tools and techniques, including:

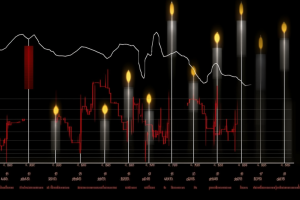

Charts and Patterns: Familiarize yourself with different types of charts (line, bar, and candlestick) and recognize common patterns (head and shoulders, double tops and bottoms, and triangles) that signal potential market movements.

Indicators and Oscillators: Utilize technical indicators such as Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands to identify trends, momentum, and potential reversal points.

Support and Resistance Levels: Identify key support and resistance levels where the price tends to find a floor (support) or a ceiling (resistance). These levels can help determine entry and exit points for trades.

Risk Management

Effective risk management is crucial to long-term success in forex trading. It involves implementing strategies to minimize potential losses and protect your trading capital. Key aspects of risk management include:

Setting Stop-Loss and Take-Profit Orders: A stop-loss order limits potential losses by closing a trade at a predetermined price, while a take-profit order locks in profits by closing a trade once a target price is reached.

Position Sizing: Determine the appropriate size of your trading positions based on your risk tolerance and the specific trade setup. Avoid over-leveraging, which can lead to significant losses.

Diversification: Spread your investments across different currency pairs and trading strategies to reduce the impact of any single losing trade on your overall portfolio.

Practical Tips For Aspiring Traders

Start with a Demo Account: Before risking real money, practice with a demo account to familiarize yourself with the trading platform and test your strategies without financial risk.

Stay Informed: Keep up with economic news and events that can impact currency markets. Economic indicators such as GDP, employment reports, and central bank decisions are particularly influential.

Develop a Trading Plan: Create a detailed trading plan outlining your trading goals, risk tolerance, and strategies. Stick to your plan and avoid emotional trading decisions.

Continuously Educate Yourself: Forex markets are dynamic and constantly evolving. Commit to ongoing education through books, online courses, webinars, and staying engaged with the trading community.

Review and Reflect: Regularly review your trades and performance to identify areas for improvement. Reflecting on both successful and unsuccessful trades can provide valuable insights for refining your approach.

Conclusion

Mastering forex trading requires dedication, discipline, and a solid understanding of market mechanics, technical analysis, and risk management. By following the guidance in this tutorial and continuously honing your skills, you can navigate the complexities of the forex market and work towards achieving your trading goals.