Introduction

The Australian pension system, known globally for its size and stability, has reached a new phase of maturity where investment strategies are becoming increasingly complex. As superannuation funds grow larger and more interconnected with global markets, currency risk has emerged as one of the most significant challenges. In recent months, financial experts and central bank officials have highlighted the need for Australian pension funds to expand their use of foreign exchange (forex) hedging. This shift is driven by the dual forces of growing offshore investments and structural changes within asset portfolios, particularly a move from equity-heavy allocations to greater exposure in fixed income assets.

The Rise Of Australia’s Superannuation System

Australia’s compulsory superannuation system has grown steadily since its introduction in the early 1990s. Today, it manages trillions of dollars on behalf of workers, making it one of the largest pension systems in the world relative to the size of the domestic economy. The scale of these funds is so vast that the domestic investment market is no longer sufficient to absorb the capital. As a result, pension funds have had to expand into international markets across North America, Europe, and Asia. This trend has created a diverse portfolio of global assets but also exposed funds to currency risk.

Currency Risk In An Expanding Global Portfolio

Currency risk arises when investments denominated in foreign currencies fluctuate in value due to changes in exchange rates. For example, an Australian fund that invests in US bonds may face losses if the Australian dollar strengthens against the US dollar, even if the underlying bond performs well. Conversely, a weakening Australian dollar can boost returns, but such gains are often unpredictable. Given the long-term horizon of pension funds, unpredictable foreign exchange movements can create distortions in portfolio returns and complicate performance reporting. This is why hedging has become a critical tool for risk management.

Shifting Portfolios And The Role Of Hedging

In recent years, superannuation funds have started to adjust their asset allocations. The earlier phases of growth relied heavily on equities, which often provided higher returns but also greater volatility. As funds mature and members begin drawing down their savings in retirement, there is a natural shift toward fixed income and other income-generating assets. Fixed income instruments tend to deliver lower but more stable returns compared to equities. However, they are far more sensitive to currency fluctuations. This sensitivity increases the importance of implementing robust hedging strategies. Without effective hedging, the relatively modest returns from bonds and debt instruments could be eroded by unfavorable exchange rate movements.

Why Hedging Matters More Now?

The global investment landscape is in flux. Interest rate cycles in major economies, geopolitical tensions, and shifting trade dynamics all contribute to exchange rate volatility. For Australian funds, which manage capital measured in trillions, even small percentage swings in currency values can translate into billions of dollars in gains or losses. Hedging does not eliminate these risks entirely, but it provides a buffer that allows funds to focus on underlying asset performance. Furthermore, hedging strategies can be tailored to balance risk management with cost efficiency. While hedging carries costs such as transaction fees and potential opportunity loss, the trade-off is often worthwhile for funds seeking predictable returns.

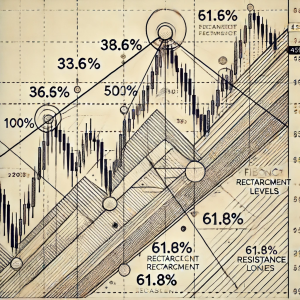

Tools And Strategies For Forex Hedging

Australian pension funds have a variety of tools available for hedging. Forward contracts allow funds to lock in exchange rates for future transactions, providing certainty in cash flows. Currency swaps offer another avenue by exchanging one currency for another over a fixed period. Options provide flexibility by giving funds the right, but not the obligation, to exchange currencies at a predetermined rate. Each of these instruments carries its own costs and benefits, and the choice of tool often depends on the size of exposure, time horizon, and market conditions. Increasingly, funds are also adopting dynamic hedging strategies, where hedge ratios are adjusted based on expected market movements, rather than relying on static levels of protection.

The Role Of Regulation And Central Bank Guidance

The Reserve Bank of Australia and financial regulators have played an important role in highlighting the risks associated with currency exposure. Officials have pointed out that as funds expand internationally, they must adopt practices that align with global standards in risk management. Regulatory guidance does not mandate specific hedging strategies, but it encourages transparency in reporting and prudent governance. This ensures that fund members can have confidence that their retirement savings are protected against unnecessary risks.

Balancing Hedging Costs And Member Returns

One of the key challenges for pension funds is balancing the cost of hedging with the goal of maximizing member returns. Over-hedging can reduce potential upside when the Australian dollar weakens, while under-hedging exposes funds to sudden losses when the dollar strengthens. Therefore, the optimal approach often lies somewhere in between. Many funds aim to hedge a portion of their foreign exposure, typically ranging from 30 to 70 percent depending on asset type and market outlook. This allows for protection against downside risks while preserving some of the potential benefits of favorable currency movements.

Lessons From Global Pension Funds

Australia is not alone in facing these challenges. Pension funds in countries such as Canada, Japan, and the Netherlands have long grappled with similar issues. Their experiences provide valuable lessons. For instance, Japanese pension funds with large foreign investments have historically relied heavily on hedging due to the volatility of the yen. Dutch funds, with their strong emphasis on liability-driven investing, also make extensive use of currency derivatives. By observing these international counterparts, Australian funds can refine their strategies and adapt global best practices to local circumstances.

Technology And The Future Of Hedging

Advances in financial technology are also reshaping the way funds manage currency risk. Sophisticated risk management platforms allow funds to monitor exposure in real time and adjust hedge positions dynamically. Artificial intelligence and predictive analytics are increasingly being used to forecast currency trends and optimize hedge ratios. Blockchain-based solutions are also emerging, promising greater efficiency and transparency in foreign exchange transactions. These innovations will play an important role in enabling Australian funds to scale their hedging activities as their international exposure continues to grow.

Implications For Fund Members

For everyday Australians contributing to superannuation, the technicalities of forex hedging may seem distant. However, the implications are very real. Currency swings can directly impact the value of retirement savings, especially as funds become more global in their outlook. By implementing effective hedging strategies, funds can provide greater stability in returns, ensuring that members have confidence in their financial future. At the same time, transparency in reporting and communication will be essential so that members understand how currency risk is being managed.

Conclusion

The growing size and global reach of Australian pension funds has brought unprecedented opportunities but also new challenges. Currency risk, once a secondary consideration, is now central to the sustainability of long-term returns. With portfolios shifting from equities to fixed income, the need for robust forex hedging has never been greater. Through a combination of prudent risk management, regulatory guidance, technological innovation, and lessons from international peers, Australian funds are well positioned to navigate this complex landscape. For members, this means a more secure retirement system that can weather the uncertainties of global markets while continuing to deliver stable and predictable outcomes.