Introduction

As Australia’s central bank, the Reserve Bank of Australia (RBA), steps into the limelight once again in May 2025, both the Australian Dollar (AUD) and the ASX 200 have surged in anticipation. This reaction marks a sharp contrast to the cautious tone that has dominated investor sentiment for months. Traders and institutional analysts alike are dissecting RBA statements, inflation data, and forward guidance, attempting to understand how monetary policy will steer the markets in the second half of the year. This article dives deep into the factors influencing the AUD and ASX 200 movements, the rationale behind investor optimism, and what future scenarios might unfold based on the RBA’s direction.

RBA’s Rate Decision: A Turning Point For Australian Assets

On May 20, 2025, the RBA surprised markets by maintaining its current cash rate, holding steady rather than enacting another anticipated cut. However, what truly captured market attention was not the rate decision itself, but the guidance provided by the central bank. The RBA’s accompanying statement hinted at a data-dependent approach, acknowledging improvements in employment figures and softening inflation trends.

For investors, this signaled that the RBA might be nearing the end of its rate-cutting cycle, prompting a repositioning of portfolios across asset classes. The ASX 200, which had already been climbing cautiously, saw immediate gains, particularly in interest-rate-sensitive sectors such as real estate and financials. The Australian dollar also rebounded, reflecting a sentiment that rate cuts might not continue as aggressively as previously forecasted.

ASX 200: Breaking Resistance And Finding Support

The ASX 200 index, a benchmark for Australian equity markets, saw a notable spike in trading volume and price following the RBA’s latest policy update. Closing above key resistance levels for the first time in months, the index signaled a broader bullish trend.

Sectoral Movements: Who Benefited The Most?

Financial stocks led the charge, boosted by the stability of interest rates, which preserved net interest margins for banks.

Consumer discretionary and retail stocks gained on expectations that lower interest rates had already encouraged consumer spending.

Healthcare and tech sectors also saw moderate inflows, indicating a return of risk appetite among institutional players.

In contrast, resources and energy stocks lagged behind, dampened by uncertainty in global commodity prices and slowing demand from China.

AUD/USD Reaction: From Weakness To Stability

The AUD/USD currency pair experienced a sharp rally in the days leading up to and following the RBA’s announcement. Having spent several weeks under pressure due to bearish sentiment and expectations of deep cuts, the shift in tone by the RBA helped the AUD stabilize above key psychological support levels.

Several macroeconomic factors contributed to the AUD’s resilience:

Improved labor market conditions: Australia’s unemployment rate dipped slightly in April, providing the RBA with breathing room.

Inflation showing early signs of easing, though still above the target range, allowed for cautious optimism.

US dollar weakness, driven by increasing expectations that the Federal Reserve may soon pause its own rate hikes, added fuel to the AUD’s recovery.

Traders who had heavily shorted the Aussie dollar were forced to cover their positions, further accelerating the rally in the currency.

Investor Sentiment: Confidence Restored Or Premature Optimism?

The prevailing sentiment across trading desks and institutional channels appears cautiously optimistic. A survey from a Bloomberg panel of analysts revealed that nearly 70% of fund managers believe the ASX 200 still has upside potential in 2025, assuming the RBA continues to support growth without triggering inflationary pressure. However, there are some red flags that investors cannot ignore:

Household debt remains high, and the housing market’s resurgence could reignite inflation.

External shocks, such as geopolitical tensions or a resurgence in global energy prices, could undermine domestic recovery.

Commodity exports, which are critical to the Australian economy, are under pressure due to slowing growth in China.

Thus, while sentiment has improved, the landscape remains highly sensitive to policy signals and data releases.

The Real Estate And Lending Boom: A Side Effect Of Rate Easing

An unintended consequence of the RBA’s dovish pivot earlier this year has been the revival of the housing market. Property prices in Sydney and Melbourne have begun to rise again, prompting concerns about affordability and speculative buying.

At the same time, mortgage lending has surged, with banks reporting higher application volumes and approval rates. While this supports economic growth in the short term, it presents a long-term risk of asset bubbles and over-leverage — issues that the RBA has historically warned against.

Policy watchers expect macroprudential regulations to be strengthened if lending continues to outpace wage growth and inflation targets.

Global Factors: The US Federal Reserve And China’s Economy

Australia’s economic health and the direction of its markets are not determined in isolation. The US Federal Reserve’s future stance on interest rates plays a critical role in shaping capital flows. If the Fed signals a pause or reversal of rate hikes, the US dollar may weaken further, offering additional tailwinds to the AUD.

Meanwhile, China’s sluggish economic recovery remains a wildcard. As Australia’s largest trading partner, any uptick or contraction in Chinese demand for iron ore, coal, and LNG directly impacts Australian corporate earnings and government revenues.

Recent data out of Beijing shows a modest rebound in construction and infrastructure spending, but persistent consumer weakness suggests the recovery is uneven at best.

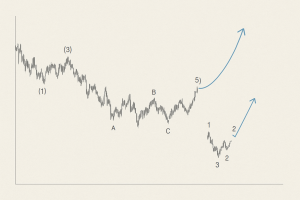

Technical Analysis: Key Levels To Watch

ASX 200

Support Zone: 7,200 – 7,250

Resistance Zone: 7,380 – 7,450

A close above 7,450 could open up a rally toward 7,600.

AUD/USD

Support Level: 0.6520

Resistance Level: 0.6700

Breakout above 0.6700 may invite bullish momentum up to 0.6850.

Traders are advised to monitor RBA speeches, CPI releases, and labor data to confirm trend continuity or reversals.

What Comes Next? Policy, Patience And Volatility

The road ahead remains uncertain. While the current data points to a recovery phase, the pace and durability of this rebound will depend heavily on continued policy alignment and the absence of negative shocks. The RBA is unlikely to raise rates anytime soon, but will remain on guard for inflation re-acceleration or credit bubbles.

For investors and traders, the best strategy in this climate may be adaptive positioning: staying alert to macro shifts while exploiting shorter-term volatility in forex pairs and equities linked to interest-sensitive sectors.

Conclusion

The surge in both the AUD and ASX 200 ahead of the RBA’s latest policy announcement underscores how deeply interwoven sentiment, central bank communication, and macro data have become. While the outlook has improved, sustained gains will only materialize if the RBA’s balancing act continues to inspire confidence without stoking systemic risks.

For traders, 2025 is shaping up to be a year defined by central bank foresight, geopolitical clarity, and technical precision. As always, caution, education, and a well-thought-out strategy remain the best allies in navigating the ever-shifting forex and equity landscape.