Introduction

The foreign exchange market recently witnessed renewed volatility after the EUR GBP currency pair declined sharply following disappointing industrial production data from the Eurozone. The movement demonstrates how sensitive currency markets are to macroeconomic indicators and how rapidly traders react when economic figures diverge from expectations. Recent statistics showed that industrial production fell significantly more than analysts predicted, raising concerns about the strength of the region’s manufacturing sector and its broader economic outlook.

The reaction in currency markets was immediate, with the euro weakening against several major currencies and the EUR GBP cross dropping noticeably and breaking technical levels that traders had been monitoring closely. This type of price movement highlights a fundamental principle of foreign exchange trading that hard economic data often overrides sentiment or speculation, especially when the numbers indicate a potential slowdown in growth or production activity.

Role Of Industrial Production In Currency Valuation

Industrial production is one of the most closely watched macroeconomic indicators in developed economies. It measures output from factories, mines, and utilities, offering insight into the real economy rather than consumer sentiment or speculative market behavior. When production declines substantially, it can indicate falling demand for goods, reduced corporate investment, and slower economic expansion.

The latest figures suggest that manufacturing weakness in the Eurozone is not an isolated occurrence but part of a broader trend that has been developing over recent months. Analysts point to declining global demand for manufactured goods, persistent energy cost pressures, and structural changes in key industries such as automotive manufacturing as contributing factors. Europe’s manufacturing sector, particularly in industrial powerhouses like Germany, has historically been a major engine of economic growth, so weakness in this area tends to ripple across the entire region.

Energy costs remain elevated relative to long term averages, compressing profit margins for industrial firms. Even though prices have eased from their peak levels, they are still high enough to limit expansion plans and discourage large scale production increases. At the same time, the transition toward electric vehicles is forcing traditional manufacturers to invest heavily in new technologies while managing declining demand for older product lines. These structural shifts create uncertainty and reduce investor confidence in the near term outlook for the sector.

Technical Outlook For EUR GBP After The Decline

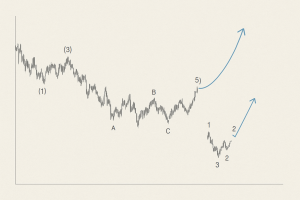

From a technical standpoint, the decline pushed the EUR GBP pair toward the lower boundary of its recent trading range. Analysts now see the mid range levels as immediate support while resistance is forming slightly above recent prices where previous buying interest once existed. Technical zones like these are important because they represent price areas where market participants have historically shown strong buying or selling activity.

If the pair breaks decisively below support levels, it could test earlier lows and confirm a bearish short term trend. Conversely, if buyers step in and push prices back above resistance, the move could prove temporary rather than the beginning of a sustained downward trend. Traders frequently combine technical signals with macroeconomic data to form a complete view of market direction. In this situation, weak economic data provides fundamental justification for bearish momentum while technical indicators help traders determine entry and exit points. The combination of both forms of analysis often increases confidence in trading decisions.

Diverging Monetary Policy Expectations

Another key factor influencing the EUR GBP trajectory is the difference in policy outlooks between European and British monetary authorities. Policymakers in the Eurozone remain cautious about persistent inflation in certain sectors and must balance the risk of slowing growth against the need to keep price pressures under control. Meanwhile, British policymakers face their own challenge of managing inflation while supporting an economy still adjusting to previous monetary tightening measures.

The contrast between these policy stances can create shifts in currency valuations because interest rate expectations are one of the most powerful drivers of exchange rates. If traders believe that interest rates in the United Kingdom will remain higher for longer than those in the Eurozone, the pound typically strengthens against the euro. However, these expectations are not fixed. They evolve as new economic data becomes available, which means upcoming releases from either region can quickly alter market sentiment and cause rapid price movements. Forex traders therefore monitor economic calendars closely, particularly when major data announcements are scheduled.

Importance Of Upcoming United Kingdom Economic Data

With the euro weakened by poor industrial data, attention has shifted to the United Kingdom and its forthcoming economic releases. Labor market statistics and inflation figures are considered especially influential because they directly affect monetary policy decisions. Forecasts suggest only modest changes in employment conditions, but wage growth remains a critical variable. Strong wage increases can signal persistent inflation since higher salaries often lead to increased consumer spending and rising prices.

If wage growth remains elevated, policymakers may feel compelled to maintain tighter monetary policy for longer than previously expected, which would likely support the pound and push the EUR GBP pair lower. On the other hand, weaker employment or inflation data could reduce pressure on policymakers and lead to expectations of rate cuts. In that scenario, the pound might weaken, giving the euro an opportunity to recover. This dynamic illustrates how foreign exchange markets are forward looking. Traders react not only to current data but also to how that data might influence future policy decisions.

Historical Behavior Of The Currency Pair

Historically, the EUR GBP exchange rate has often reflected relative economic performance between the Eurozone and the United Kingdom. During periods when the euro area economy struggled, the pair traded significantly lower. Conversely, when the United Kingdom faced economic uncertainty, the pound weakened and the pair moved higher. In recent months, however, the pair has largely traded within a range, indicating that investors see risks in both economies.

This range bound behavior suggests that neither currency currently holds a decisive advantage. The latest drop following weak industrial production may therefore represent a short term reaction rather than the beginning of a long lasting trend. Range bound markets often occur when traders lack strong conviction about future economic direction. In such conditions, currencies fluctuate between support and resistance levels as new data points gradually shape expectations. Only when a clear divergence emerges between two economies does a sustained trend typically develop.

Influence Of Global Market Sentiment

Currency movements rarely depend solely on domestic data. Global risk sentiment also plays a significant role. In risk averse environments investors frequently move funds into currencies considered safer or more stable. Although the pound is not traditionally viewed as a classic safe haven currency, it can still be sensitive to global growth concerns because the United Kingdom has a large financial services sector that is closely connected to international capital flows.

The euro’s performance is similarly linked to regional stability and energy security issues. Geopolitical tensions affecting energy supplies can influence inflation expectations and economic forecasts across Europe, which in turn impacts currency valuations. Because of these interconnections, foreign exchange markets often move based on a combination of domestic indicators, global economic trends, geopolitical developments, and investor sentiment. Traders who focus only on one factor risk missing the broader picture that ultimately drives exchange rate movements.

Why The Recent Move Matters For Traders?

The latest decline in EUR GBP is significant not only because of the size of the move but also because of what it reveals about market psychology. When economic data surprises negatively, traders tend to react quickly and decisively. This reaction can create momentum that continues even after the initial news impact fades. The drop also highlights the importance of expectations. Markets had anticipated only a modest decline in industrial production, so the larger than expected contraction triggered stronger selling pressure.

For professional traders, such events create opportunities. Short term traders may attempt to capitalize on momentum while longer term investors may use the move to reassess fundamental valuations. Understanding the underlying reasons behind currency movements is therefore essential for making informed trading decisions.

Outlook For The Euro And Pound In The Near Future

Looking ahead, the trajectory of EUR GBP will likely depend on whether economic data continues to diverge between the Eurozone and the United Kingdom. If Eurozone indicators remain weak while British data shows resilience, the pair could trend lower. Conversely, if European data stabilizes and United Kingdom figures disappoint, the euro might regain strength.

Another crucial variable is communication from monetary authorities. Even subtle changes in tone from policymakers can shift expectations about future interest rates, which often leads to rapid currency movements. Investors therefore analyze speeches, meeting minutes, and policy statements carefully for clues about policy direction. Volatility may remain elevated as markets digest new information. In such environments, traders often rely more heavily on risk management strategies such as stop losses and careful position sizing to protect against unexpected price swings.

Conclusion

The recent decline in the EUR GBP exchange rate following disappointing Eurozone industrial production data underscores how tightly currency markets are linked to real economic performance. Weak manufacturing output signaled potential economic slowdown and triggered immediate selling pressure on the euro, pushing the pair toward key technical levels. At the same time, attention has shifted to upcoming United Kingdom economic releases that could determine whether the move continues or reverses.

Ultimately, the direction of this currency pair will depend on a complex interaction of factors including economic data, monetary policy expectations, global risk sentiment, and investor confidence. The latest development serves as a reminder that foreign exchange markets are dynamic systems where new information is rapidly priced in, making them both challenging and potentially rewarding for those who understand the forces that drive currency valuations.