Introduction

The Indian rupee opened the week on a cautious note after slipping past the key psychological barrier of 90 per U.S. dollar. Although the currency began Monday’s session at approximately 90.23, appearing steady on the surface, the underlying sentiment remains fragile amid continued global and domestic pressures. The rupee’s recent slide has been shaped by a combination of persistent foreign portfolio outflows, a widening trade deficit, and higher dollar demand in offshore markets. These forces have collectively weakened confidence in the currency’s near-term stability.

Despite Monday’s stable opening, market participants remain wary. The rupee recently hit a record low around 90.42 per dollar, highlighting how deeply structural and cyclical pressures continue to weigh on India’s external position. Many analysts note that the currency is struggling not because of one-off events, but because of multiple stress points converging simultaneously.

Rising Forward Premiums Bring Some Relief But Not Enough

An important development accompanying the rupee’s decline has been the rise in forward premiums. The one-month forward premium increased slightly, while the one-year implied yield also moved higher. This shift suggests an increase in hedging demand, largely driven by exporters seeking to lock in more favourable rates as the rupee weakens. The market has also seen excess liquidity in cash dollars, helping push near-term swap rates upward.

These developments indicate that forward markets are attempting to counter some of the volatility in the spot market. Exporters convert more of their dollar earnings when forward premiums rise, providing temporary support to the rupee’s value. However, experts caution that such flows cannot reverse the currency’s broader challenges unless underlying macroeconomic drivers improve. The rise in forward activity is seen less as a correction and more as a stabilizing measure within a turbulent market.

Portfolio Outflows Continue To Undermine The Currency

Foreign portfolio outflows remain one of the most significant drags on the rupee’s performance. Investors have been steadily pulling money out of Indian equities, leading to a steady drain on capital inflows. The Indian stock market, though fundamentally strong in many respects, has witnessed a year marked by uncertainty, particularly as global risk appetite fluctuates amid geopolitical shifts and monetary policy divergences.

This trend has contributed heavily to the rupee’s current weakness. Weak FDI flows and muted external commercial borrowing activity have compounded the situation. As global conditions tighten and interest rate differentials shift, India’s ability to attract portfolio capital has diminished, leaving the rupee more vulnerable to global currency movements.

Multiple analysts point out that unless foreign inflows pick up, the rupee may be unable to find sustained relief even if short-term corrections occur.

Trade Deficit Widening Adds Additional Pressure

India’s trade deficit has been expanding, creating further downward pressure on the rupee. Imports have risen faster than exports, leading to a widening current account imbalance. Weak external demand has dampened export performance, and global uncertainties continue to weigh on major export sectors such as textiles, engineering goods, and IT services.

The widening deficit reduces the amount of foreign currency flowing into the country and increases the demand for dollars to pay for imports. This structural imbalance exerts continuous pressure on the rupee, especially during periods of global volatility. The situation is further complicated by India’s reliance on energy imports, which become more expensive as the rupee weakens.

Economists warn that unless export competitiveness improves or global conditions shift in favour of emerging markets, the rupee may continue to face depreciation pressures.

Stalled Trade Talks Add To Market Uncertainty

Another factor weighing heavily on the currency is the uncertainty surrounding ongoing trade discussions between India and the United States. Lack of progress in these talks has created apprehension among investors who were hoping for a breakthrough that could stimulate trade, investment, and inflows.

The absence of positive developments in bilateral trade relations has made the currency more sensitive to short-term negative news. Analysts note that a favourable trade agreement could potentially boost investor confidence and give the rupee some much-needed support. Until then, the lack of clarity continues to hinder sentiment around India’s external-sector outlook.

Impact Of Global Monetary Policy And Capital Shifts

Global monetary policy remains a crucial external factor influencing the rupee’s trajectory. Market participants are watching the U.S. Federal Reserve closely as expectations build around a potential rate cut. While a Fed cut normally eases pressure on emerging-market currencies, analysts suggest that the rupee may not see significant improvement even if global rates decline. India’s domestic challenges—trade deficits, portfolio outflows, and structural dependence on imports—continue to overshadow what would have otherwise been positive global developments.

Even if global investors return to emerging markets after a Fed cut, there is no guarantee that India will attract proportionate capital inflows unless its domestic fundamentals show improvement. That makes the rupee’s outlook particularly cautious in the current environment.

Key Resistance And Support Levels In Focus

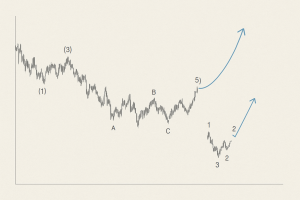

In the near term, market strategists highlight specific technical levels that could guide the rupee’s movement. The 90.30 level is seen as an important point of resistance, while the 89.20 to 89.50 range may act as a significant support zone. These levels reflect broader market expectations about where the currency may stabilize if external conditions remain unchanged.

However, if outflows persist and trade conditions do not improve, these support levels may not be strong enough to prevent the rupee from weakening further. Some financial institutions even warn that the rupee could slide toward 91 or 92 per dollar in the coming months if a meaningful trade breakthrough does not materialize soon.

Potential Scenarios Ahead: What Could Stabilize The Rupee?

Despite the fragile environment, several factors could help stabilize the rupee:

Exporter Activity and Forward Conversions

With forward premiums rising, exporters may increase their conversions of dollar earnings into rupees. This can help increase supply in the currency market and provide temporary relief.

Improved Capital Inflows

Any positive shift in foreign portfolio investments, especially if global risk appetite improves, would strengthen the rupee’s position.

Trade Negotiation Breakthroughs

A favourable outcome in India’s trade discussions with major partners could significantly boost investor confidence.

Lower Global Interest Rates

If global monetary conditions ease, emerging markets such as India may benefit from renewed capital inflows over time.

While these factors could help, most analysts maintain that structural improvements in India’s external sector are necessary for sustained stability.

Conclusion

The Indian rupee’s movement beyond the 90 per dollar mark symbolizes deeper economic and structural pressures. The combination of portfolio outflows, a widening trade deficit, and weak global sentiment has placed the currency under persistent stress. While forward-market dynamics and exporter activity provide pockets of relief, they are not sufficient to counter the broader challenges.

The rupee’s outlook remains cautious. Meaningful stability will depend on improvements in capital inflows, trade performance, and global economic conditions. Until then, analysts expect volatility to continue as India navigates a complex global environment and its own internal imbalances.